Tax Relief Act 2024 Summary Pdf – On January 22, 2024, the Federal Trade Commission (FTC) released the revised Hart-Scott-Rodino (HSR) Act jurisdictional thresholds for 2024. The FTC is required by law to revise the HSR Act monetary . one path to diminish their tax obligation is taking part in tax relief initiatives. Administered by the federal government and certain state entities, these programs offer various advantages .

Tax Relief Act 2024 Summary Pdf

Source : www.energy.gov

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

Brad Johnson on X: “From today’s House Appropriations Committee

Source : twitter.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

Randy Crabtree on LinkedIn: Big news! Bridging the Gap 2024

Source : www.linkedin.com

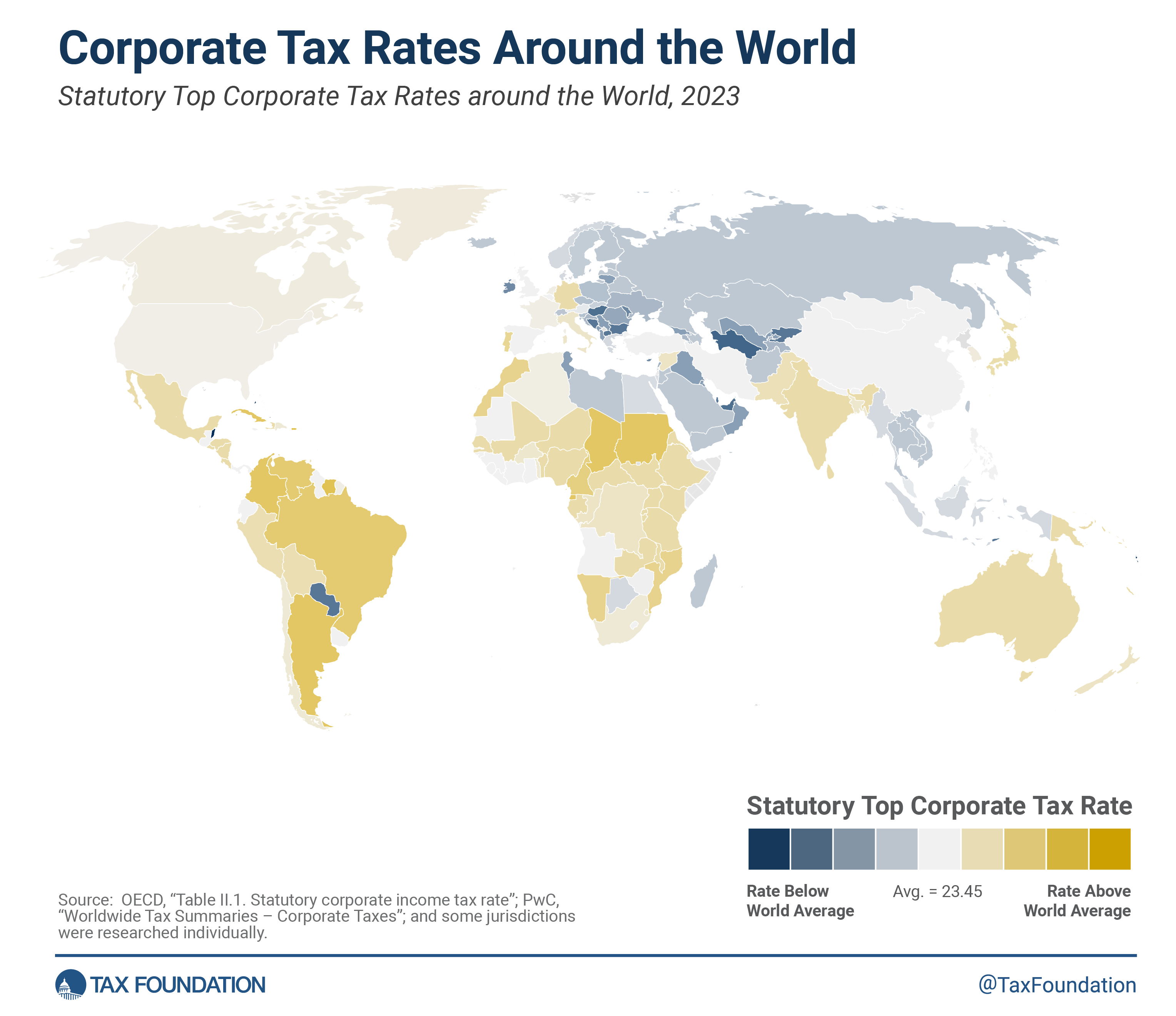

Corporate Tax Rates around the World, 2023

Source : taxfoundation.org

Jen Coleslaw on X: “oh also this one. https://t.co/ICSK6ewTUi” / X

Source : mobile.twitter.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

Who Pays? 7th Edition – ITEP

Source : itep.org

Electric Vehicles: EV Taxes by State: Details & Analysis

Source : taxfoundation.org

Tax Relief Act 2024 Summary Pdf Federal Solar Tax Credits for Businesses | Department of Energy: In October, Gov. Maura Healey signed a $1 billion tax relief package designed to benefit renters, caregivers, and seniors. The law went into effect when it was signed, but with residents poised to . Stephanie Do of the Council On State Taxation discusses key state tax policy topics that are likely to see action in 2024, including the expiration of Tax Cuts and Jobs Act provisions. This .